EV Boom, Meet the Cliff: Tax Credit Sunset Triggers a Rush Now — and a Slump Next

For a lot of buyers, the $7,500 federal tax credit was the nudge that made an electric car make sense. Dan McGrath in Cincinnati is one of them. He and his wife jumped on a Hyundai Ioniq 5 lease in August because the credit ends Sept. 30.

“Now or never,” he said. “The car became much more affordable with the tax credit.”

That same calculus lit up showrooms across the country. August EV sales popped 18% to 146,332, and analysts figure September will look hot too. But once the incentive disappears, so does much of the momentum. The fourth quarter is expected to be ugly, and 2026 could start slow as the market searches for its footing.

“Next year could be a pretty dreadful year for EVs in this country,” warned Morgan Stanley’s Adam Jonas.

Automakers see the wall coming and are tapping the brakes. Production of battery models is being slowed, launches delayed, and money re-routed toward gas and hybrid vehicles. It’s a stark turn from the chest-thumping just a few years ago when everyone was sure an all-electric future was right around the corner.

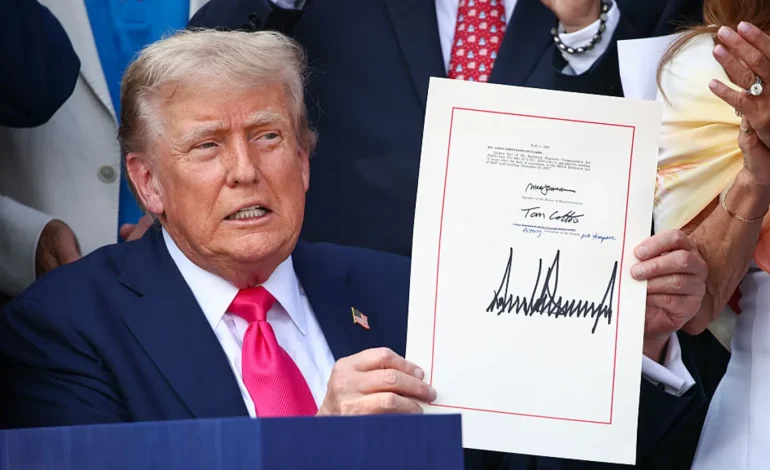

Policy is the pivot. The Trump administration’s One Big Beautiful Bill Act axed the longtime EV incentive while loosening fuel-economy pressure and hiking auto tariffs. With less regulatory heat — and most EV programs still unprofitable — legacy brands have fewer reasons to push volume at a loss. GM’s CFO Paul Jacobson put it bluntly: scaling will be slower, and capital is shifting from splashy model proliferation to grinding down EV costs. GM has idled its Hamtramck EV plant and scheduled downtime in Tennessee; Honda binned an electric Acura; Stellantis nixed a battery Ram; Nissan is halting Ariya imports from Japan. Ford, after racking up big EV losses, is rebooting its plan around cheaper models—but not before 2027.

Startups don’t have a gas backstop. Tesla and Rivian live and die by EV demand, and they’re also losing a rich revenue stream as emission-credit markets cool. Tesla still booked $439 million from credits last quarter, but that cushion shrinks as rules change and legacy makers catch up.

The near term won’t be helped by mixed signals from Washington. FDA greenlit the latest Covid vaccines but limited eligibility to older and high-risk adults—one of several moves by HHS under Secretary Robert F. Kennedy Jr. that rattled investor nerves across “policy-sensitive” sectors. In autos, the coming EV reset is more straightforward: pull the federal lever, watch demand dip. GM’s Jacobson expects sales to “drop off pretty precipitously” in October and November before the market finds its natural level. Hyundai’s José Muñoz and Elon Musk have sounded similar notes, bracing for rough quarters.

There’s a twist, though. The incentive’s looming sunset pulled a lot of purchases forward. Tesla even ran a countdown on its site. Cox Automotive thinks third-quarter EV sales hit a record 410,000 vehicles — about a 10% share — with average manufacturer incentives for EVs cresting above $9,000, more than double the industry norm. Once the clock runs out, the sugar high fades. Then we get to see what real, unsubsidized demand looks like.

None of this means the electric project is over. Places like Germany and Canada saw sales swoon after subsidies ended, then slowly climb again. The path back likely runs through price. A redesigned Nissan Leaf landing around $30,000 shows where the puck is headed. GM is talking about a $30,000 pickup. Analysts keep repeating the same mantra: compelling EVs around thirty grand change the math for mainstream buyers.

Between now and then, expect a messy transition. Plants will run fewer shifts. Launch timelines will slip. Hybrids will hog more ad time. But the appetite for quiet, quick, tech-forward cars hasn’t vanished; it’s been artificially inflated for years and is about to be measured for real. As one industry watcher put it, the credit was a key catalyst, and its end is a stress test. If carmakers meet buyers with the right mix of price, range, and reliability — without a federal crutch — the slump will look more like a speed bump than a dead end.

With input from the New York Times and CNBC.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned