CNBC, Reuters, and Investor’s Business Daily contributed to this report.

Quantum names ripped higher after a report said the Trump administration is exploring equity-for-funding deals with leading firms — a move that would mirror recent government stakes in rare earths and semiconductors and dial up America’s tech rivalry with China.

The Wall Street Journal said officials have discussed giving Commerce Department equity in exchange for federal grants, with IonQ, Rigetti and D-Wave among the companies in the mix, and Quantum Computing Inc. and Atom Computing weighing similar terms. The Journal also flagged potential awards starting around $10 million per company. Shares jumped on the headlines: IonQ rallied double digits, D-Wave surged, Rigetti climbed, and smaller peers rose in sympathy. A quantum-focused ETF also ticked higher. (A Commerce spokesperson later told Reuters the department is “not currently negotiating with any of the companies,” underscoring how fluid the talks appear.)

The approach would extend Washington’s more interventionist posture in “strategic” supply chains. In recent months the government took roughly a 15% position in MP Materials after a $400 million Defense Department investment and about 10% of Intel to bolster domestic AI chipmaking. Officials have argued taxpayers should share upside when public money seeds critical industries.

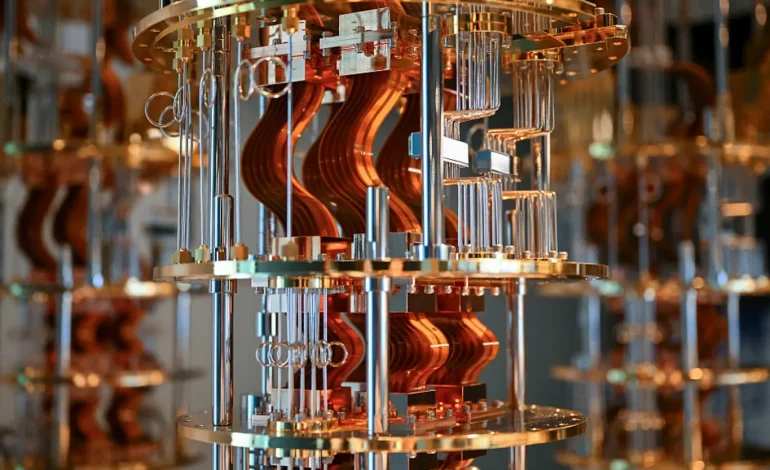

Why quantum, and why now? Quantum computing — which exploits quantum mechanics to tackle problems classical supercomputers can’t — is increasingly seen as the next battleground in US–China competition, with big implications for defense, cybersecurity, materials science and drug discovery. Major tech players have sketched aggressive roadmaps, but the field remains early-stage and capital intensive; many pure-play stocks are volatile, revenue-light and years from commercial scale. Federal equity could provide patient capital while tightening national-security alignment.

For traders, the takeaway was simple: policy headline = bid. After sharp pullbacks from recent highs, quantum shares found fresh momentum on the prospect of government backing — even as the official line suggests nothing is finalized. In a market this headline-sensitive, that was enough to flip the switch from quantum wobble to quantum pop.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned