With input from the Wall Street Journal, CNN, CNBC, Reuters, and AP.

Redemption Day on Wall Street didn’t last long. By lunchtime Thursday, it had morphed into something closer to Reckoning Day.

Coming into the session, the market was basically obsessing over two things:

- Is the AI trade — and especially Nvidia — finally running out of steam?

- Is the Fed about to cut rates again in December?

Early on, traders thought they’d gotten neat, soothing answers.

First, Nvidia dropped another monster earnings report Wednesday night, the kind that usually shuts down “AI bubble” talk for a while. Investors took it as proof that demand for high-end AI chips is still roaring.

Then came Thursday morning’s jobs report. Unemployment ticked up unexpectedly, and payrolls showed the economy shed jobs in August for the second time in three months. To markets, that smelled like a Fed rate cut in December to cushion the labor market.

Cue the relief rally. Stocks ripped higher at the open — the Dow was up more than 700 points at one stage — and traders exhaled.

And then… the floor dropped out.

By late morning, the rally started fading. By midday, sentiment had flipped, hard. The same indexes that were partying at breakfast were sliding again by lunch, ending with a brutal reversal. The Dow swung roughly 1,100 points from high to low — its biggest intraday lurch since the tariff chaos back in April — and finished down nearly 400. The S&P 500 lost about 1.6%, the Nasdaq more than 2%. Nvidia went from up around 5% to closing down about 3%. Bitcoin pulled a similar stunt, jumping above $92K early before sliding toward the mid-$80Ks.

So what spooked everyone?

Turns out the “answers” just created nastier questions.

Nvidia’s numbers weren’t just strong — they were off the charts. And that’s exactly why investors got nervous. If you’re already the most valuable company on Earth and you just posted ridiculous growth again, the next question becomes: what’s left to surprise the market?

At some point, expectations get so high that even amazing results don’t feel like enough. Traders started to wonder whether Nvidia’s pace can stay this insane, and whether the rest of the AI universe is overpriced even if Nvidia is legit.

Once the initial “bad jobs = easier Fed” headline glow wore off, investors took a closer look. The report also showed stronger-than-expected hiring in September, hinting that the summer slowdown might be fading. The unemployment rate may have risen partly because more people re-entered the labor force — not because layoffs suddenly surged. In other words, the data wasn’t a clean “Fed must cut” signal after all.

And that matters because Fed messaging is split. Minutes from the last meeting showed meaningful resistance to cutting again in December, but some officials are sounding more open to it. So if jobs are “not that weak,” a December cut is suddenly less guaranteed… and the market hates that kind of ambiguity.

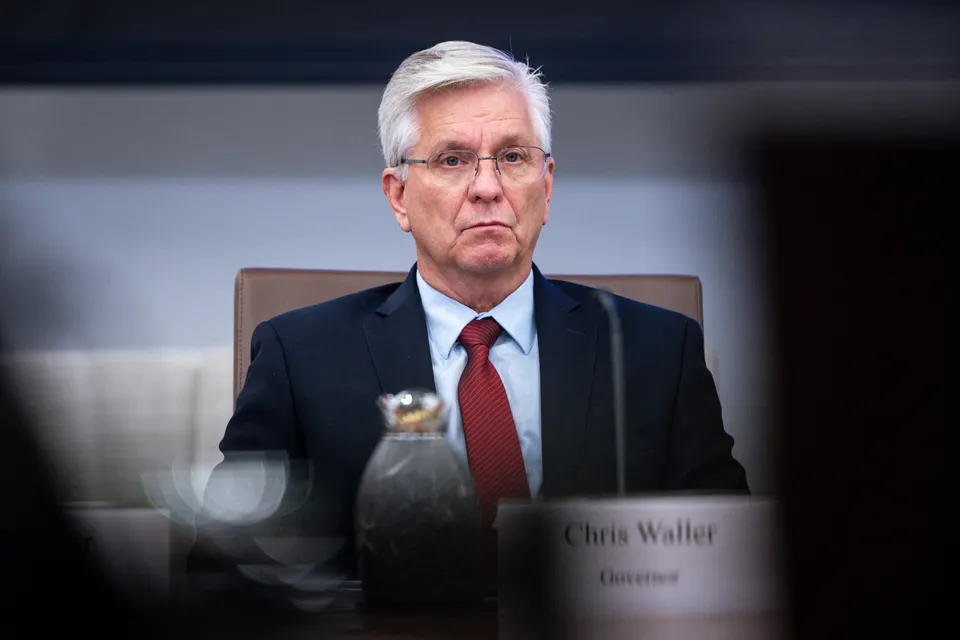

By Friday morning, stocks were trying to stabilize. A speech from New York Fed President John Williams nudged rate-cut odds back up — he said policy is still “modestly restrictive” and there may be room to ease in the near term. Traders latched onto that, pushing December cut odds up to roughly the 70%+ range.

That helped futures and the big indexes claw back some losses. But the bigger vibe didn’t change: investors are still jumpy about tech valuations, still unsure about the Fed, and still in full risk-off mode when it comes to stuff like crypto and high-multiple AI names.

Bottom line: Thursday’s meltdown wasn’t about one data point or one company. It was the market realizing it’s stuck between two uncomfortable possibilities:

- AI might be peaking or

- AI might be fine but priced like it’ll grow forever

…and the Fed might cut or - the Fed might hold because things aren’t weak enough.

Until one of those uncertainties clears up, expect more whiplash. With earnings season winding down, shutdown-delayed government data still messy, and holiday vacations around the corner, the market may not get clean answers soon — which is exactly how volatility stays alive.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned