The original story by for WyoFile.

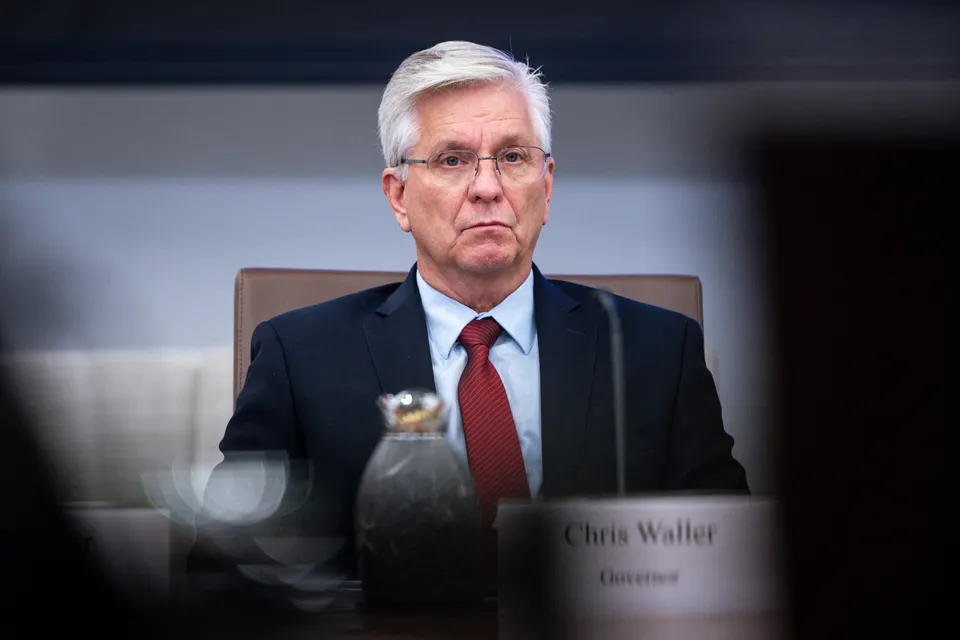

Elizabeth Aranow thought she knew what to expect from health insurance. Then she opened this year’s Affordable Care Act marketplace.

Her monthly premium for 2025? Jumping from $600 to $3,000.

“We haven’t purchased a plan yet, because I’m reeling from sticker shock,” said Aranow, who lives in Lander with her husband.

The cheapest marketplace option they can find is about $1,800 a month — still more than double what they pay now, with worse coverage.

They’ve started talking about big life changes: new jobs with benefits, or cutting other expenses to the bone. Going without insurance feels too risky.

“To me, not having insurance is not an option,” Aranow said.

She’s needed multiple surgeries in recent years and knows how quickly medical bills can pile up.

She’s not alone. Roughly 45,000 Wyomingites who buy coverage on the ACA marketplace are being hit with some of the largest premium increases in the country.

For a 60-year-old in Wyoming earning around $63,000 a year, average monthly premiums are rising by a staggering 421%, according to health policy outlet KFF. No other state even comes close. The same person would see premiums rise 231% in Montana, 166% in Colorado, 192% in Utah and 134% in Idaho.

“It’s pretty terrifying,” Aranow said.

Not everyone will see hikes that extreme — increases vary by age, income and plan — but advocates fear the shock will push people into bare-bones private plans with weak coverage or out of the insurance system entirely.

“I think that we’re going to see a lot of people just not buy insurance and take the gamble that if something happens, they’ll be able to figure out how to pay it off through the hospital,” said Jenn Lowe, executive director of Healthy Wyoming, which pushes for more affordable care.

She worries that will mean more medical debt, more unpaid hospital bills (which drives up costs for everyone), worse health as people skip preventive care — and a lot more stress.

“All of this should be very concerning to health care consumers in the state,” Lowe said. “Now that the expiring tax credits are coming and people are seeing in real time what the increase in costs are going to be, I think a little bit of reality is hitting that we have some of the most expensive insurance in the nation.”

The ACA marketplace is meant for people who don’t qualify for Medicaid and don’t get insurance through a job. For years, it’s been propped up by extra federal help.

In 2020, during the pandemic, Congress created Enhanced Premium Tax Credits to make ACA plans cheaper. Those subsidies slashed premiums — in some cases down to $0 per month for low-income buyers — and helped drive the uninsured rate to record lows.

But they were expensive. The Congressional Budget Office estimated extending them would add about $212 billion to the deficit over 10 years. Fiscal conservatives argued that wasn’t sustainable.

Congress extended the credits once in 2022… then let them expire this year. A fight over the subsidies was a major sticking point in the recent government shutdown.

The final deal did not include another extension.

At the same time, insurers raised their base rates, and one of Wyoming’s few marketplace options — Mountain Health Co-op — pulled out of the state altogether. Now there are just two insurers left on the exchange.

Put all that together — higher base prices, fewer subsidies, less competition — and you get the kind of numbers Wyoming is seeing now.

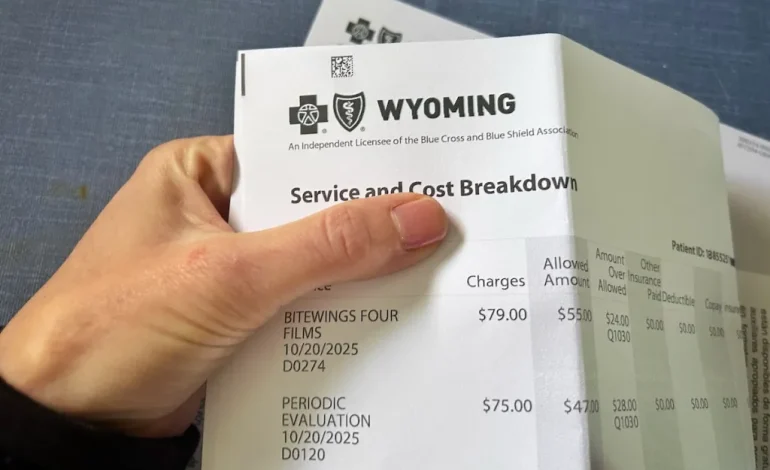

At the Lander Free Medical Clinic, staff have been hearing from patients who were previously helped onto cheap or even $0 marketplace plans.

Medical assistant Audrey Zanetti described one patient whose plan was set to auto-renew.

“It was going to auto-renew to a similar plan,” she said. “Except that the new premium would have climbed from $0 to $650.”

That’s about 40% of the person’s monthly income — and that’s just the premium, not counting co-pays or deductibles.

“And so if that individual hadn’t come in, they would have been locked into that plan, it would have auto-renewed,” Zanetti said. “They would have seen the bill come January or February, and would have said, ‘I can’t afford that.’ They would have canceled the plan, and then not been eligible [to re-enroll] because they’re outside of open enrollment.”

That kind of pitfall is easy to miss. Health insurance is already confusing, and automatic renewal sounds like a convenience — until the price changes overnight.

In the past, Wyoming residents could lean on “navigators” — trained helpers who walk people through the marketplace and their options. Those positions were mostly paid for with federal funds.

This year, the US Department of Health and Human Services cut navigator funding by 90%.

Enroll Wyoming, which used to have 10 staffers helping people sign up, is now down to one full-time and one part-time employee.

To cope, Enroll Wyoming is building a loose network of partner organizations and health counselors around the state. The Lander Free Medical Clinic is one of them; VISTA volunteer Stephanie Kohm recently got certified to help.

“We wanted to set up a system where people could still get help,” said Enroll Wyoming Navigator Katelyn Befus. “We brought in the organizations and partners that we’ve been working with for years, and leaned on them a little bit to become certified.”

Even so, Befus is “extremely” busy.

“I’m literally completely booked for appointments all the way through the first half of enrollment,” she said — through at least Dec. 15.

She’s hearing plenty of frustration. People want to know why their premiums are suddenly skyrocketing and what happened to the tax credits they’d grown used to.

Households just above 400% of the federal poverty level — about $62,600 for one person — are getting hit especially hard, she said. Many are looking at $5,000-a-month premiums for a family of four.

“For a lot of them, they just can’t afford that much money,” Befus said.

She’s often forced to recommend shopping for off-exchange private plans instead.

If you want ACA coverage starting Jan. 1, you must enroll by Dec. 15. If you sign up between Dec. 15 and Jan. 15, your coverage starts Feb. 1.

Befus urges people not to wait until the last second — and not to blindly let plans auto-renew.

“I really encourage people to go to the Healthcare.gov website and use the ‘browse plans and prices’ tool to see what their expected tax credit and premium is before they jump in,” she said.

And if you’re looking beyond the marketplace, she says, be careful. Call insurance companies directly, read the fine print and make sure you understand what’s covered and what isn’t.

“There are a ton of fake and scammer websites out there,” Befus warned.

Lowe, with Healthy Wyoming, says there’s one more thing people can do: call their members of Congress.

During the tax-credit fight, Republicans mostly opposed extending the subsidies, while Democrats pushed to keep them.

Wyoming’s US Sen. John Barrasso, a physician and longtime critic of the ACA, told NBC’s Meet the Press that “Obamacare is a failed measure” and that Republicans want to replace it with something that actually lowers costs.

“I’ve always wanted people to get the care they need, from a doctor that they choose, at a price they can afford — and Obamacare basically destroyed that possibility,” Barrasso said. “We cannot just continue to subsidize a failing plan, which is causing more and more costs and hardship around the country.”

Lowe’s response: it’s one thing to attack the ACA. It’s another to offer a real alternative.

“Republicans committed to talking about health care insurance once the government reopened,” she said. “Well, guess what? The government is reopened. Let’s talk about health care insurance. You guys don’t want the marketplace. How are you going to be able to provide health care insurance to the people of Wyoming?”

Health insurance, she said, is proven to help people live longer, healthier lives.

“It’s a policy solution that we know works.”

Now, Lowe says, is the time for Wyoming residents staring at four- or five-figure monthly quotes to press their elected officials:

“If not this,” she said, “then what?”

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned