With input from Reuters, the Financial Times, Bloomberg, CNBC, and Investor’s Business Daily.

Wall Street hit the brakes Monday morning, with all three major indexes opening lower as investors chose caution over conviction ahead of a big week for economic signals and a closely watched speech from Federal Reserve Chair Jerome Powell.

At the opening bell:

- Dow Jones Industrial Average was down about 135 points (-0.28%) to 47,580.85;

- S&P 500 slipped 0.54% to 6,812.30;

- Nasdaq Composite dropped 0.83% to 23,172.34.

The move lower comes after a strong run last week and a choppy November, as traders try to figure out whether the Fed is really done cutting rates—or might even go further at its meeting later this month.

Stocks opened in the red and stayed there through the morning:

- The S&P 500 was recently down around 0.4–0.6%;

- The Dow fell roughly 0.4–0.6%;

- The Nasdaq lagged, down close to 0.8–0.9%.

Small caps were weak too:

The Russell 2000 dropped about 0.7%, underperforming the broader market.

The pullback comes right after a strong week where:

- The Dow and S&P 500 each jumped more than 3%;

- The Nasdaq rallied nearly 5%.

Seasonally, December tends to be a friendly month for stocks. Since 1950, the S&P 500 has averaged an advance of more than 1% in December, making it the index’s third-best month, according to the Stock Trader’s Almanac.

So what’s the problem? In short: data, the Fed, and nerves.

Investors are largely in “wait-and-see” mode ahead of:

- A speech from Fed Chair Jerome Powell, which could offer clues about how confident the central bank feels about inflation and growth;

- Key economic releases, including:

ISM manufacturing data;

ADP private payrolls later in the week;

The Fed’s preferred inflation gauge, the PCE Price Index, due Friday.

“The market is still hesitating a bit ahead of the upcoming macro data, and before the Christmas rally people typically expect,” one strategist said.

Traders are currently pricing in around a 90% chance of another quarter-point rate cut at the Fed’s December meeting. That doesn’t leave much room for even more “dovish” surprises, which makes any hint of caution from Powell especially important.

The first big data point of the week didn’t help sentiment.

The ISM manufacturing index for November:

- Fell to 48.2%, from 48.7%;

- Anything below 50 signals contraction in factory activity;

- Economists had expected a slightly stronger 48.8%.

Details under the hood weren’t great:

- Supplier deliveries dropped sharply to 49.3%, slipping below the expansion line;

- Employment fell by 2 points;

- Inventories rose;

- Prices edged a bit higher.

In other words: factories are still under pressure, while costs are not falling in a way that would fully reassure inflation-watchers.

Risk assets are moving together again — and today, that’s not a good thing.

Bitcoin slid more than 5–6%, dropping back below $87,000 and trading closer to the mid-$80,000s. Other major cryptos, including Ether, Solana, BNB, and Dogecoin, were also deep in the red.

That weakness in digital assets has spilled over into equities, particularly the high-growth, high-risk corners of the market.

“Today’s pullback in equities is correlated with the strong dip in crypto assets,” one strategist at HSBC noted, though he added that crypto itself doesn’t drive the fundamentals of earnings, rates, or inflation.

Still, when investors dump speculative assets, it often signals a “risk-off” tone that hits tech and small caps first — exactly what we’re seeing.

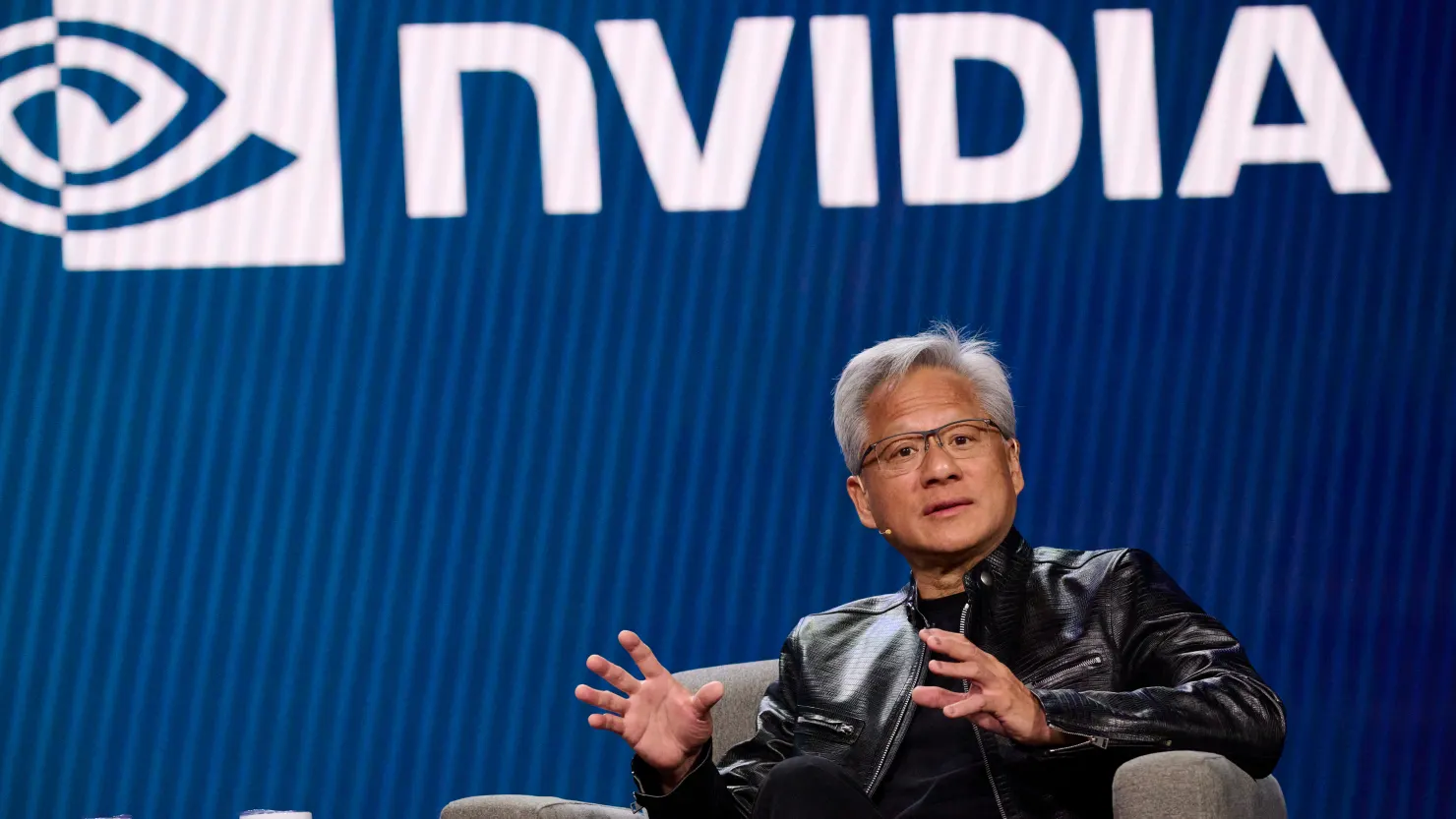

The recent AI trade that has powered much of this year’s rally also came under fresh pressure:

- Broadcom fell more than 3%;

- Super Micro Computer slipped more than 2%;

- Nvidia, Micron, and Marvell Technology all traded lower, with Nvidia down around 1–2% in early action.

Some investors are clearly taking profits after a huge run and growing chatter about an “AI bubble”.

One bright spot: Synopsys.

- Shares of Synopsys jumped 7–8% after Nvidia announced a $2 billion investment in the chip design software maker as part of a broader AI and engineering partnership.

- Nvidia’s stock, interestingly, was still lower on the day despite being the one writing the check.

Other notable movers:

- Leggett & Platt surged about 14% after receiving an unsolicited all-stock buyout proposal;

- Wynn Resorts added nearly 2% after Goldman Sachs put it on its “conviction buy” list.

On the Dow:

- Amazon, Microsoft, and Nike traded modestly lower;

- Chevron and Boeing managed small gains.

Away from stocks and crypto, the macro picture showed a classic risk-off mix:

- The 10-year US Treasury yield ticked up to around 4.04–4.07%, putting some pressure on equities;

- West Texas Intermediate (WTI) crude traded around $59–$59.30 a barrel, up roughly 1%;

- Gold gained about 0.4–0.5%, trading near record levels above $4,200 per ounce, as some investors looked for safety.

After a wild November — with AI valuations questioned, crypto whipsawing, and central banks recalibrating — some market watchers see Monday’s weakness as a normal breather rather than the start of something nastier.

“Stocks are going through a period of digestion,” said Robert Schein, chief investment officer at Blanke Schein Wealth Management. “But we think the backdrop for stocks remains strong right now, especially given the high likelihood that the Federal Reserve will cut interest rates again next week.”

Still, with:

- Bitcoin sliding;

- AI names wobbling;

- Manufacturing data missing expectations;

- And Powell set to speak soon.

Traders aren’t in a hurry to add risk. For now, Wall Street is starting December on a cautious note — watching and waiting to see whether the Fed and the data will justify another year-end rally or put the brakes on it.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned