With input from the Hill, AP, Forbes, and FOX News.

It may already be too late for California to stop the bleeding. That’s the uncomfortable reality setting in as a proposed wealth tax aimed at the state’s billionaires sends shockwaves through Silicon Valley — and pushes some of its biggest names toward the exits.

At the center of the controversy is a ballot initiative backed largely by progressive groups and labor unions, most notably the Service Employees International Union. The proposal would slap a one-time 5% tax on Californians with assets over $1 billion. On paper, that sounds straightforward. In practice, it’s anything but.

The tax doesn’t just target cash sitting in bank accounts. It reaches deep into unrealized gains — things like stock holdings, private companies, intellectual property, art and collectibles. In other words, wealth that exists on paper but hasn’t actually been cashed out. For tech founders whose fortunes are tied up in companies they built but haven’t sold, that’s a major problem.

If the state demands billions in taxes on wealth that isn’t liquid, the only way to pay could be selling shares or even entire companies. That’s not just a tax — critics argue it’s forced liquidation. And to make matters worse for anyone hoping to plan ahead, the proposal is retroactive. If it passes, it would apply to anyone deemed a California resident as of Jan. 1, 2026, even if the law isn’t approved until later.

Tech leaders aren’t waiting around to see how this plays out.

High-profile entrepreneurs have already started making moves. Peter Thiel has shifted his base to Florida. Larry Page has reportedly snapped up massive real estate in Miami and moved dozens of companies out of California. Sergey Brin is trimming his California footprint. David Sacks moved his business to Texas. Venture capitalist Chamath Palihapitiya has openly warned that the policy would gut California’s tech economy and has hinted at relocating as well.

This isn’t theoretical anymore. The flight has begun.

That’s what makes this moment especially risky for California. The state already relies heavily on its wealthiest residents. Nearly half of California’s personal income tax revenue comes from the top 1% of earners. In a state facing persistent budget deficits and rising costs, losing even a small slice of that tax base could blow a massive hole in public finances.

Supporters of the tax say the money is needed to fund healthcare and social services, especially after federal funding cuts. They argue the ultra-wealthy can afford it and that fears of mass relocation are overblown. Some academics backing the proposal insist that most billionaires won’t actually leave.

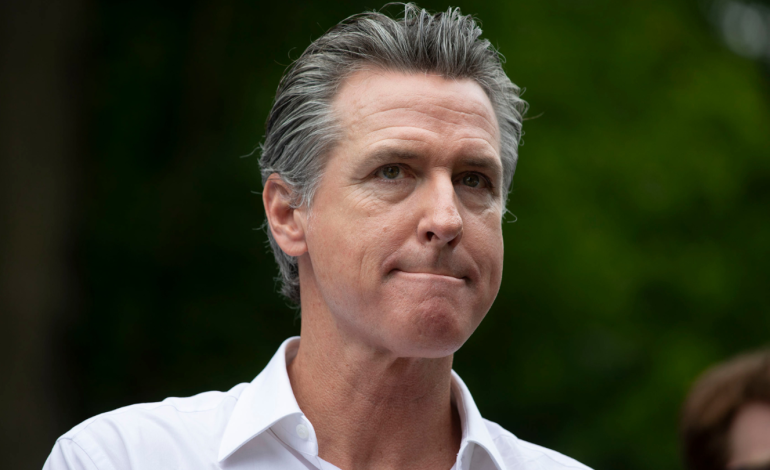

But even Governor Gavin Newsom isn’t buying it.

Newsom has come out strongly against the measure, warning that a state-level wealth tax would put California at a competitive disadvantage and could backfire badly. He’s tried to block the initiative before it reaches the ballot, arguing that taxing the ultra-wealthy should be handled nationally, not state by state. With an eye on a possible 2028 presidential run, Newsom is acutely aware that a billionaire exodus would be a political and economic nightmare.

Democrats are deeply split. Progressive heavyweights like Sen. Bernie Sanders and Rep. Ro Khanna have embraced the proposal, framing it as a moral issue in a state with extreme income inequality. Business groups and many tech leaders — including some who lean liberal — say the tax is poorly designed and economically reckless.

Polling suggests voters are conflicted too. Early surveys show slim majority support, but that backing drops sharply once people hear arguments about capital flight, retroactive taxation and impacts on jobs and investment.

And all of this is happening against a broader backdrop that California can’t ignore. For years now, people and money have been flowing out of high-tax, high-cost states and into places like Texas and Florida. IRS and Census data show California losing both population and adjusted gross income, while red-state competitors rack up gains.

Those states aren’t being subtle about it either. Texas Gov. Greg Abbott and Florida Gov. Ron DeSantis have openly welcomed California refugees, touting lower taxes, lighter regulation and what they call economic sanity.

California, meanwhile, already has the highest state income tax rate in the country. Add a retroactive wealth tax on top of that, and critics say the message to entrepreneurs is clear: build elsewhere.

The irony is hard to miss. California still has more billionaires than any other state and remains the global center of tech innovation, fueled recently by the AI boom. But policies like this risk undermining the very ecosystem that created that wealth in the first place.

If the tax fails at the ballot box, supporters may call it a missed opportunity. If it passes, the consequences could be far more severe — shrinking investment, fewer startups, lost jobs and a thinner tax base.

For now, the damage may already be done. Even the threat of the tax has pushed billionaires to rethink where they live, work and invest. California is betting that they’ll stay. Silicon Valley’s biggest players are signaling they’re not so sure.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned