The euro plummeted to its lowest level in two years on Friday, falling more than 1% to $1.0335, as traders bet that the European Central Bank (ECB) will be forced to aggressively cut interest rates to support the struggling eurozone economy, Bloomberg reports.

The currency’s sharp decline follows weaker-than-expected business activity data from Germany and France, the bloc’s two largest economies. This data fueled market speculation of a significant rate cut, with the implied probability of a half-point cut next month surging to over 50%, up from approximately 15% on Thursday.

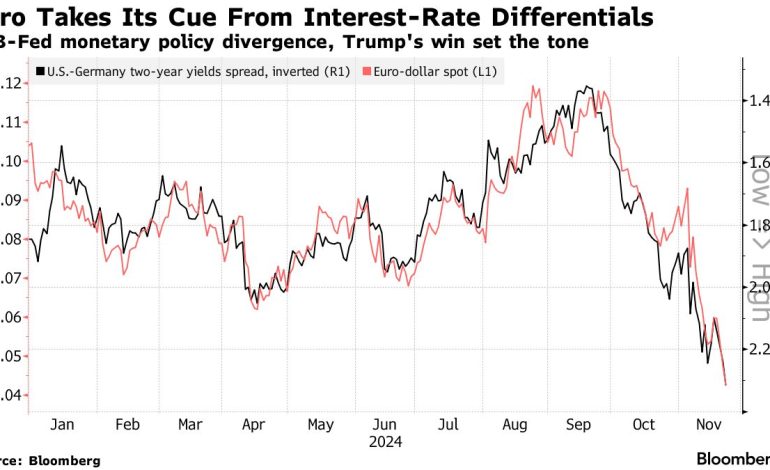

The euro has been one of the worst-performing G10 currencies in the past three months, weighed down by concerns over potential US tariffs under a hypothetical Donald Trump presidency and ongoing political instability in Germany and France. These factors have eroded investor confidence.

Traders are increasingly anticipating a further decline in the euro, potentially pushing it towards parity with the dollar – a level it has only reached twice since its inception in 1999. The cost of hedging against further losses in the options market is near a five-month high.

The latest data presents a significant challenge for ECB policymakers, who must decide next month whether to accelerate easing measures in response to the weakening economy. This contrasts sharply with the US, where expectations of tax cuts under a different political scenario have led to forecasts of stronger growth.

The bleak economic outlook triggered a surge in euro-area bonds, with two-year German bund yields dropping 13 basis points to 1.98%, their lowest point since 2022. Traders now anticipate approximately 150 basis points of rate cuts over the next year.

“The currency is under immense pressure,” commented Kristoffer Kjaer Lomholt, head of FX research at Danske Bank.

He attributed the pressure to “broad-based concerns for the cyclical outlook for the eurozone and, by extension, the easing outlook from the ECB.” The composite Purchasing Managers’ Index (PMI) for the eurozone fell to 48.1, signaling contraction. The deterioration in the services sector was particularly concerning, marking the first decline since January.

Adding to the uncertainty, the ongoing conflict between Ukraine and Russia continues to cast a shadow over the region’s economic prospects, according to Christian Mueller-Glissmann, head of asset allocation research at Goldman Sachs.

However, despite the pressure for aggressive rate cuts, the ECB may proceed cautiously. Elevated natural gas prices and rising wages in the eurozone present inflationary risks, potentially tempering the pace of easing. ECB Vice President Luis de Guindos recently cautioned against rushing the process, citing uncertainties such as trade tensions and global conflicts.