In recent weeks, the financial markets have experienced volatility, with concerns emerging over the trajectory of stocks, inflation, and consumer confidence, CNBC reports.

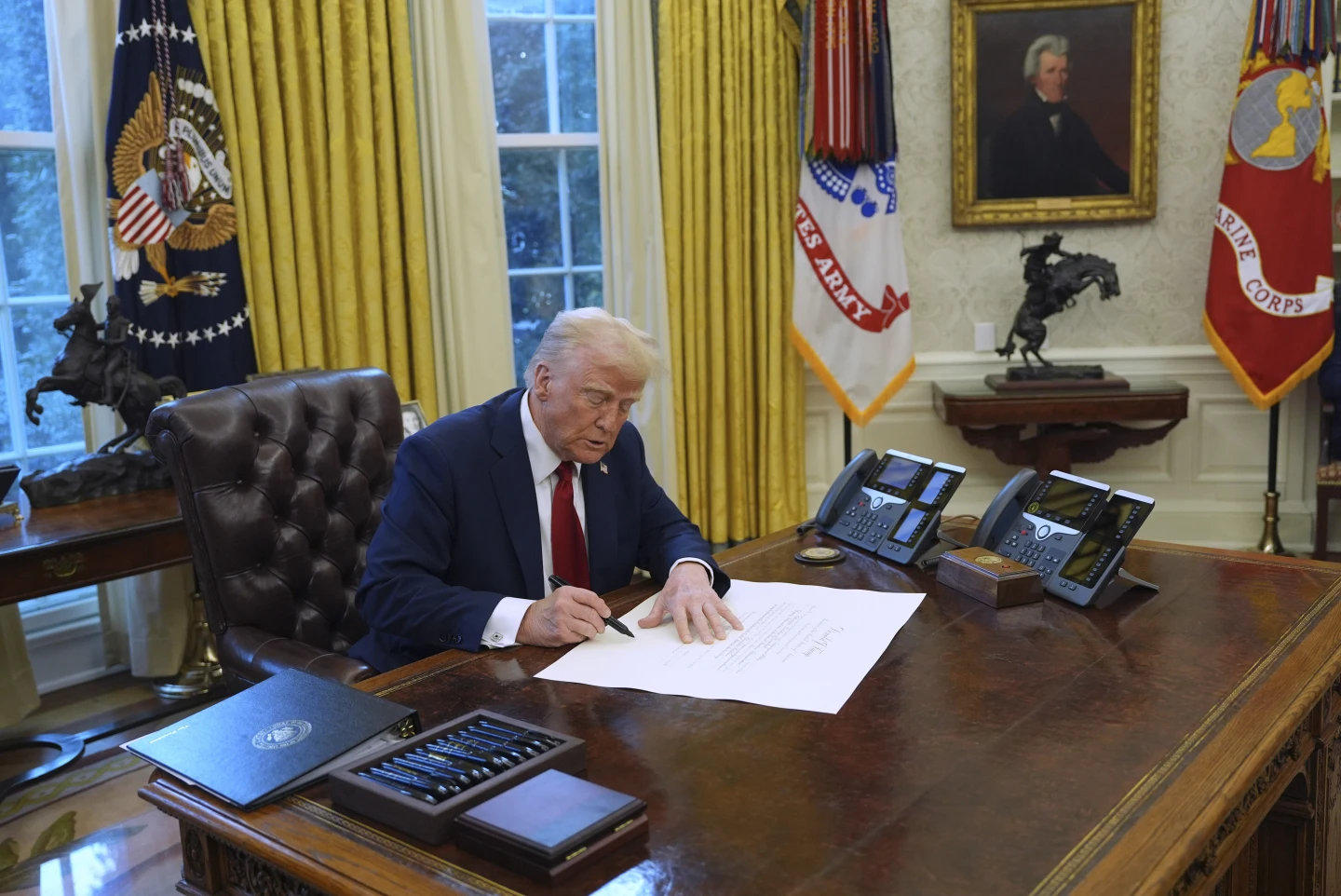

However, while some analysts point to market downturns as a sign of economic uncertainty, others see these shifts as necessary adjustments in response to President Donald Trump’s bold economic policies.

The so-called “Trump Bump”—a surge in stock prices and other assets following Trump’s election—has shown signs of leveling off. Some companies, such as Tesla, have seen their stock prices decline, with Tesla’s drop driven by concerns about CEO Elon Musk’s focus on political engagement rather than company performance. However, the overall market remains strong, with the Dow Jones Industrial Average posting gains and key industries adapting to policy changes.

While the Nasdaq Composite has dipped, some financial experts believe this is a normal market correction rather than an indication of long-term weakness. Tom Lee, head of research at Fundstrat Global, referred to the recent downturn as a “flesh wound,” implying that markets are likely to recover, especially as investors take advantage of lower stock prices.

The US Conference Board’s Consumer Confidence Index fell to 98.3 in February, reflecting concerns about inflation and employment opportunities. However, this drop in sentiment comes amid broader economic transitions, including Trump’s focus on rebalancing trade relationships through tariffs and strengthening domestic production. Historically, short-term pessimism often precedes long-term gains, particularly as businesses adjust to new policies aimed at boosting American industries.

One of the major concerns among investors and consumers is the impact of Trump’s tariffs. While tariffs can temporarily increase costs for businesses that rely on imports, they are designed to encourage domestic manufacturing and reduce dependence on foreign production. This strategy aligns with recent corporate moves, such as Apple’s announcement of a $500 billion investment in US infrastructure and job creation.

Additionally, Super Micro Computer, a major tech company, successfully avoided Nasdaq delisting by filing its financial results on time. This highlights the resilience of American corporations in navigating regulatory challenges while continuing to grow.

While critics have coined terms like “Trump Slump,” it’s important to recognize that economic transformations often come with temporary volatility. Trump’s policies, focused on reducing reliance on foreign markets, protecting American jobs, and boosting domestic production, may take time to yield full benefits.

As companies adjust and new economic policies take hold, many experts remain optimistic about the long-term prospects of the US economy. While certain stocks have fluctuated, industries such as defense, infrastructure, and manufacturing are seeing renewed investment, reinforcing Trump’s vision of a stronger, self-sufficient America.