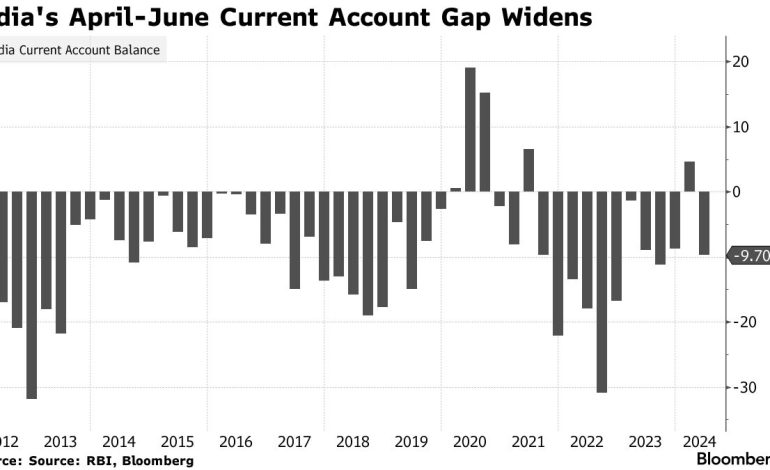

India’s current account deficit widened slightly in the April-June quarter, driven by a growing trade gap fueled by rising imports and sluggish exports. Bloomberg reports.

The Reserve Bank of India (RBI) reported a shortfall of $9.7 billion, equivalent to 1.1% of the country’s gross domestic product (GDP), marking a shift from a revised surplus of $4.6 billion in the previous quarter.

The widening trade deficit, which reached $65.1 billion during the quarter, compared to $56.7 billion a year ago, was attributed to robust domestic demand and weak outbound shipments. However, the central bank noted that services exports remained strong, bolstered by healthy activity in computer, business, and travel sectors.

“The reading is broadly in-line with expectations,” commented Teresa John, economist at Nirmal Bang Institutional Equities, who anticipates a gap of around 1.2% of GDP for the current financial year.

The wider deficit is likely to exert further pressure on the Indian rupee, which has been hovering near record lows in recent weeks. However, RBI Governor Shaktikanta Das has assured that the central bank will intervene to prevent excessive volatility in the rupee by utilizing its foreign reserves.

According to the RBI statement, private transfer receipts, mainly representing remittances from Indians working overseas, amounted to $29.5 billion, a rise from $27.1 billion in the same period last year.

In addition, met foreign direct investment recorded a net inflow of $6.3 billion, compared to $4.7 billion in the corresponding period of 2023-24, the statement read.

Net inflows under foreign portfolio investment moderated to $0.9 billion from $15.7 billion in the same period a year earlier, the RBI stated.