Nike Inc. shares fell sharply on Friday, pushing the company’s market value below $100 billion for the first time since the early days of the Covid-19 pandemic, Bloomberg reports.

The decline followed an earnings report that indicated ongoing struggles with revenue and profitability, raising concerns about the pace of the company’s turnaround efforts.

Nike’s stock dropped as much as 9.3% during the trading session, reaching its lowest level since March 2020. The selloff wiped out roughly $9 billion in market value, bringing Nike’s total capitalization down to $97 billion. This marks the sixth consecutive quarter in which Nike shares have fallen after an earnings announcement. The company’s stock has now lost more than 60% of its value since reaching a record high in November 2021, when its market capitalization peaked at approximately $281 billion.

Nike has warned of further declines in revenue and profitability in the current quarter, citing a strategic “merchandise reset” aimed at revitalizing sales. Additionally, the company acknowledged that newly implemented tariffs on imports from China and Mexico—where it has major manufacturing operations—will further impact its financial outlook.

The sales slump, which began under former CEO John Donahoe, has persisted despite efforts to stabilize the business. However, some industry analysts believe the company’s long-term fundamentals remain strong.

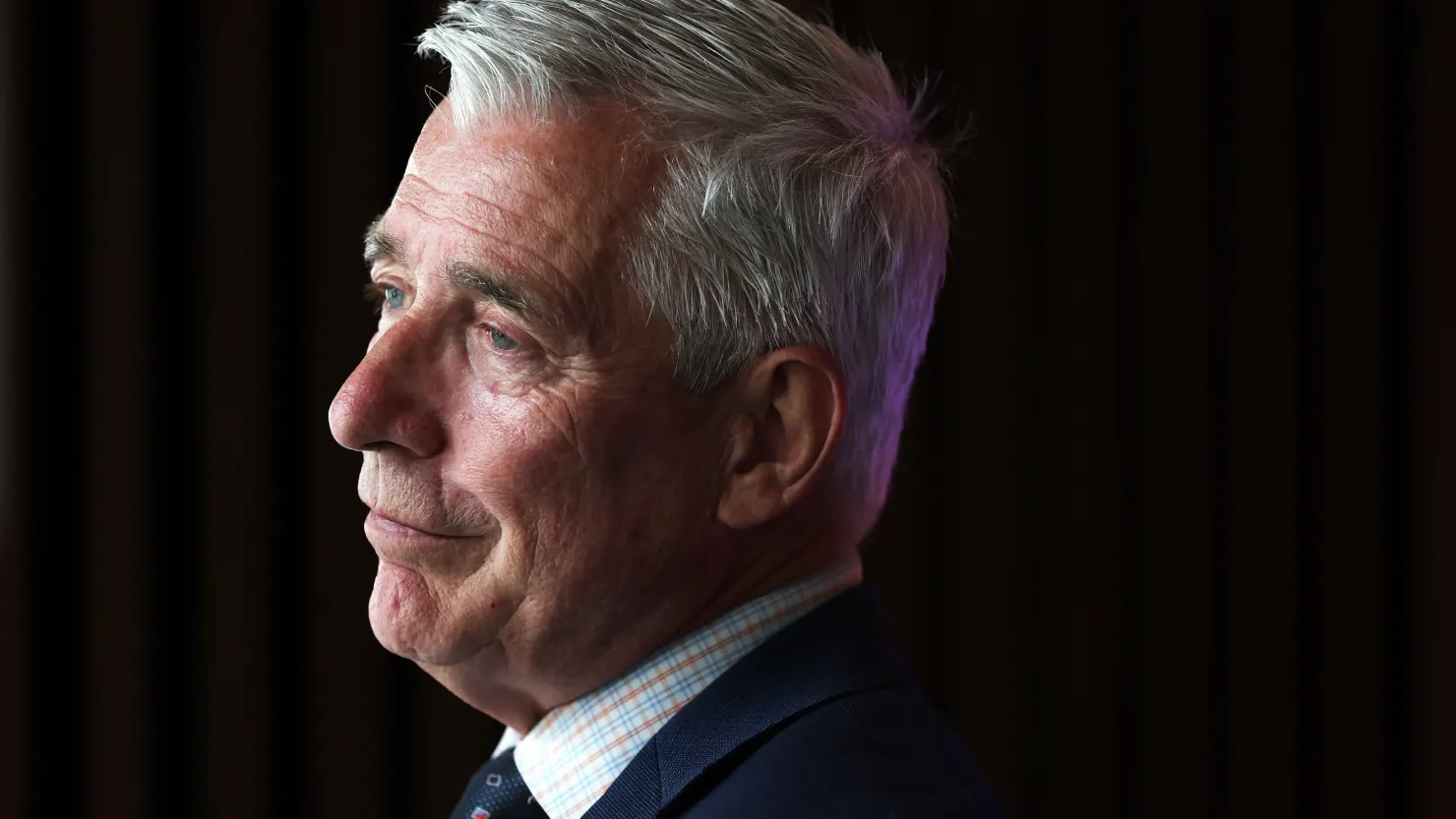

Elliott Hill, a veteran Nike executive who returned from retirement to take over as CEO in October, is seen as a key figure in Nike’s turnaround efforts. Some investors remain optimistic that his leadership can help steer the company back to growth, though they acknowledge that progress will take time.

“He’s eyes wide open and understands how much lifting is required,” said Kevin McCarthy, a portfolio manager at Neuberger Berman, which holds Nike shares. “There’s a very real turnaround with a smart architect at the top, but it’s a tanker ship and it’s going to take time to move it around.”

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned