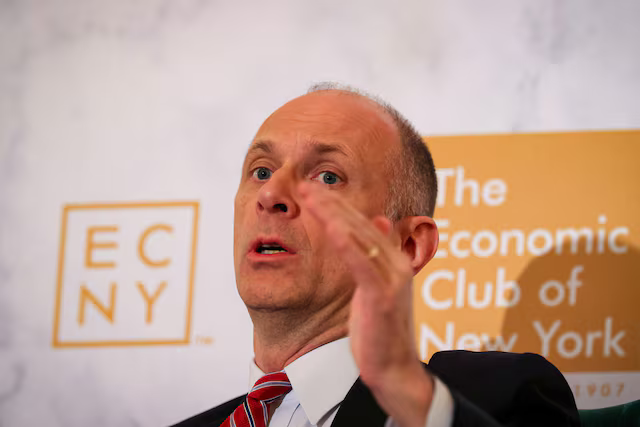

In a recent appearance on CBS’s Face the Nation, Chicago Federal Reserve President Austan Goolsbee stressed the importance of maintaining the Federal Reserve’s independence from political influence.

His comments come in response to recent public criticisms from former President Donald Trump directed at Fed Chair Jerome Powell.

Goolsbee, speaking broadly about the role of the central bank, highlighted that countries where monetary policy is shaped independently of political pressure generally see more favorable economic outcomes.

“There’s virtual unanimity among economists that monetary independence from political interference is really important,” he said.

Goolsbee warned that undermining the Fed’s autonomy could have significant consequences.

Trump, who appointed Powell during his presidency, has frequently criticized the Fed for not lowering interest rates, and recently called for Powell’s removal in a social media post. At a White House event, he reiterated his dissatisfaction, suggesting that if he wanted Powell out

“He’d be out of there real fast.”

Despite the sharp rhetoric, legal experts have noted that a president cannot fire the Fed Chair over policy disagreements alone. Powell himself, in a speech earlier this month, indicated that the central bank is proceeding cautiously amid economic uncertainties, signaling no imminent change in interest rate policy.

Goolsbee responded to the political pressure by stating:

“I strongly hope that we do not move ourselves into an environment where monetary independence is questioned. Because that would undermine the credibility of the Fed.”

The Federal Reserve, tasked with promoting stable prices and full employment, was designed to operate independently from both Congress and the executive branch. That structure, many economists argue, is essential for long-term economic stability. Goolsbee pointed out that countries lacking central bank independence often experience higher inflation, slower growth, and weaker job markets.

The discussion around Fed independence has gained renewed attention as economic policy debates intensify in an election year. Alongside tensions over interest rates, concerns about tariffs and inflation have contributed to broader market uncertainty. Trump’s tariff proposals, including an initial sweeping announcement followed by a temporary pause, have added to the uncertainty faced by businesses and investors.

Reuters, USA Today, and the Hill contributed to this report.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned