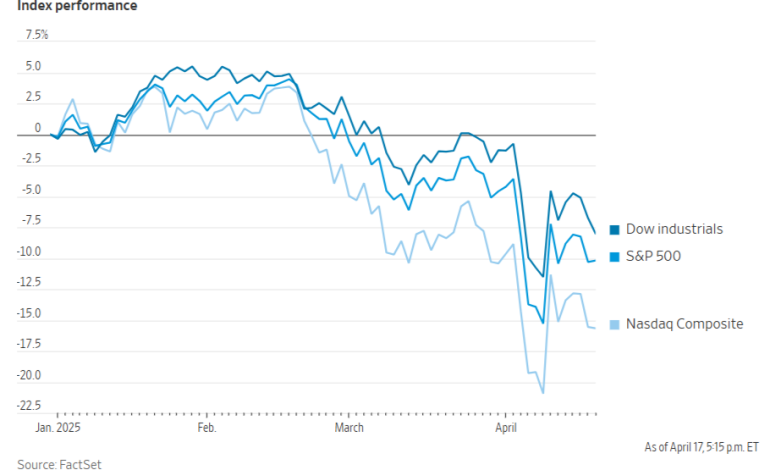

As corporate earnings season ramps up, traders are preparing for a period of heightened market turbulence, driven in part by newly announced US tariffs and growing economic uncertainty, the Wall Street Journal reports.

Analysts say the current environment is shaping up to be one of the most volatile earnings seasons in years.

Recent data from JPMorgan Chase indicates that options traders are pricing in post-earnings stock moves of around 8% for companies in the Russell 1000 index that have yet to report. This marks the most significant expected volatility since the first quarter of 2020, when the onset of the COVID-19 pandemic sent shockwaves through global markets.

The market has already seen dramatic reactions to earnings reports. UnitedHealth shares dropped 22% after the company’s latest earnings fell short of expectations and it issued a more cautious outlook for 2025.

This week brings a dense slate of earnings reports from major companies including Tesla, Boeing, and Chipotle. Investors and analysts are expected to pay particular attention to future guidance rather than backward-looking results, especially since the recent US tariffs—described as the most significant in decades—were introduced in early April, after the conclusion of the first quarter.

“It’s going to be more about the guidance,” said Mark Hackett, chief market strategist at Nationwide.

He noted that the impact of the tariffs and broader economic developments will be clearer in companies’ outlooks for the rest of the year.

United Airlines, for instance, recently presented two separate profit scenarios based on whether the US economy slides into a recession. Such examples underscore the level of uncertainty facing corporate leadership and investors alike.

Amid this ambiguity, Wall Street strategists have been revising their market expectations. According to Hackett, price targets for the S&P 500 have recently been reduced by about 11%. However, full-year earnings estimates have only declined slightly, though some analysts suggest those forecasts may also be lowered in the coming months.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned