For many football fans, the road to the 2026 FIFA World Cup, the first ever hosted across three nations, begins not on the pitch, but in the ticket portal. When FIFA opened the second phase of ticket sales this week, the buzz was instantaneous. More than a million seats have already been sold, and with the “domestic exclusivity” window now in effect for fans in the US, Mexico, and Canada, the scramble to secure a spot in the stands has turned into a microcosm of modern sports economics: part lottery, part luxury market, part test of patience.

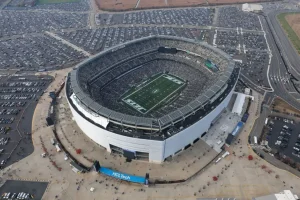

The stakes are enormous. With 7.1 million seats across 16 venues, a new dynamic pricing model, and mounting uncertainty about visas and logistics, FIFA’s 2026 tournament will be both the largest and the most complex in history. It’s also the most expensive, a live experiment in how far global demand for live sport can stretch before it snaps.

To unpack what’s happening behind the numbers, The Wyoming Star spoke with Victor Matheson, a sports economist at the College of the Holy Cross, who has studied mega-event economics for decades, and who, as fate would have it, recently became one of the lucky fans to win FIFA’s ticket lottery in Boston.

It’s hard to know exactly how everything will shake out. So, I am here in Boston and won the lottery to purchase tickets for group games. Basically only $300 and $400 tickets were available. FIFA advertised $60 tickets, but there appear to be essentially none of those actually available for sale. Obviously the teams are not yet known.

That discrepancy between the affordable dream and the economic reality sits at the heart of FIFA’s new model. Officially, entry-level tickets start at $60, but scarcity has already pushed most available prices into the mid-hundreds. While some fans are grumbling, Matheson sees one silver lining.

One nice factor I appreciate is no Ticketmaster fees. Pricing is transparent. Great for either domestic or international buyers.

Indeed, the absence of opaque service charges, a chronic pain point in US event ticketing, has won FIFA some rare praise. But as Matheson explains, the economics of demand will soon take over.

So mathematically, half of all group round games will feature a team from pot one, all of which will be a top 10 team in the world. If Argentina or Brazil or England is that team, I suspect resale markets will drive up prices above the face value, even at $300 or $400. But one out of every six games will feature the two worst teams in the group — imagine Uzbekistan v. Panama. Hard to believe that tickets to those sorts of games won’t be available on the cheap.

This dual reality, scarcity at the top, surplus at the bottom, is what makes the 2026 tournament a perfect case study in dynamic market segmentation. For locals, especially in host cities like Los Angeles, Dallas, and Toronto, the path to attending a match may be relatively smooth.

As long as a local fan just wants to go see a game and doesn’t care about the teams, I think most people will have a chance to find at least something that works for them, even on the resale markets.

But for international fans, Matheson warns, flexibility is a luxury they don’t have.

International buyers can’t be quite so cavalier about just waiting and getting whatever is available because they are less flexible due to housing and travel issues. And I suspect visa issues may loom large given the chaos of the US State Department in the Trump era.

Visa uncertainty and travel costs are shaping up to be as decisive as ticket prices themselves. Fans who bought early, even at inflated prices, may ultimately fare better than those waiting for bargains.

And yet, Matheson suggests there’s an odd kind of logic to FIFA’s aggressive pricing strategy.

I would note that I think this tournament FIFA is really trying hard to maximize its ticket revenue in a way we haven’t seen before. While this seems like pure profiteering on the part of FIFA, quite honestly, if people are willing to pay $1500 a ticket to see England play Germany in a quarterfinal, I would rather have FIFA earn that money than a scalper or an organized ticket bot farm.

It’s a provocative point, and one that cuts to the heart of modern sports capitalism. FIFA’s strategy, for all its flaws, may represent a push to reclaim profit from the grey market that has long siphoned billions from fans. But it also underscores how far removed the “people’s game” has drifted from people’s prices.

Either way, FIFA has found a way to make even the act of buying a ticket part of the global spectacle.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned