The original story by for

Uranium just got a big upgrade in Washington, and a company eyeing a future mine near Shoshoni thinks that could finally turn into real momentum — and maybe real money — for Wyoming’s nuclear comeback.

In November, the federal government updated its list of “critical minerals” and added uranium. The Interior Department’s reasoning: these materials matter for national security, economic stability and supply chain resilience — basically, the stuff you don’t want to depend on geopolitical rivals for.

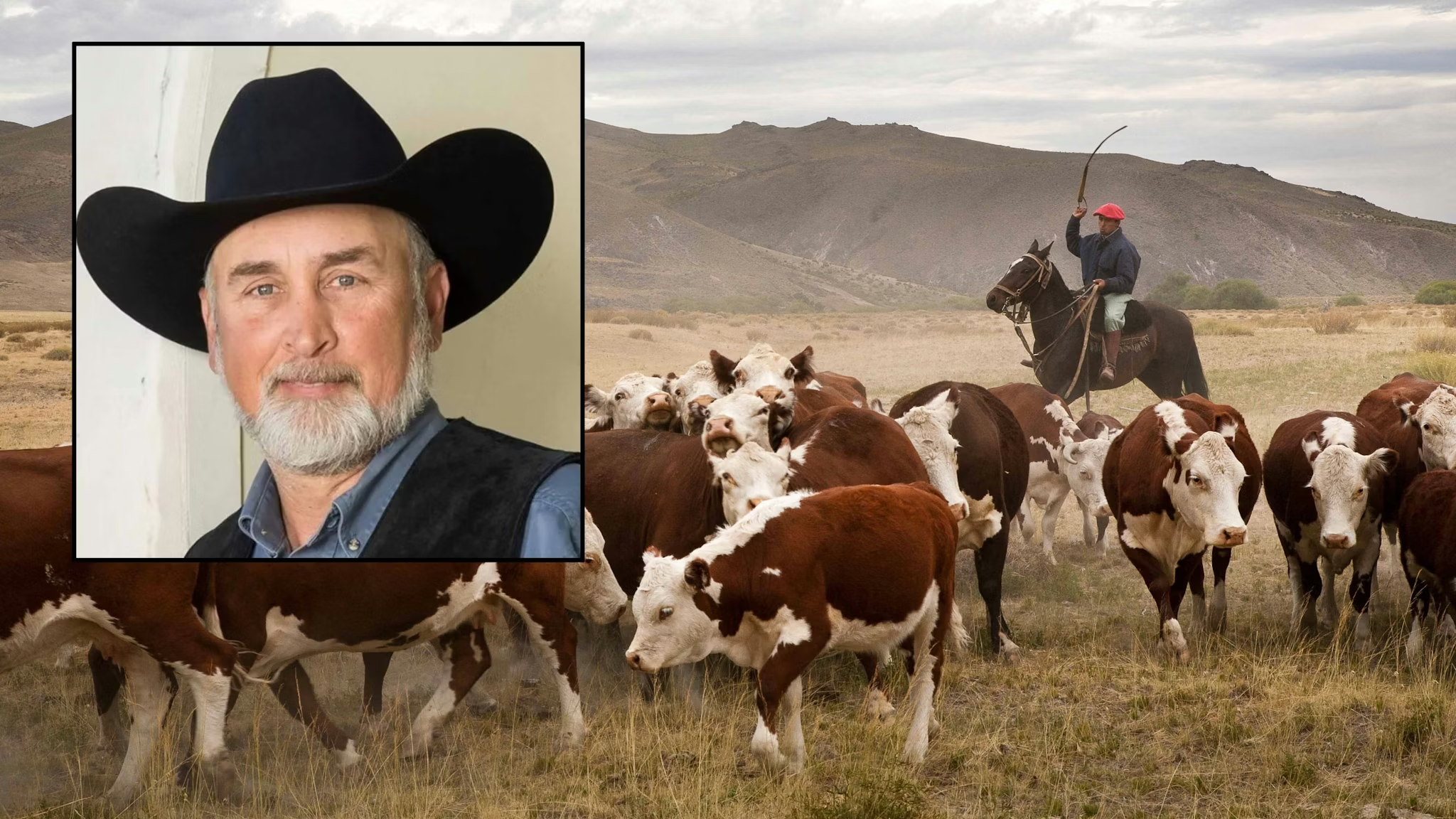

That’s welcome news for Thomas Lamb, CEO of Myriad Uranium, which has been drilling and collecting data at Copper Mountain, a desert hillside just outside Shoshoni. Myriad isn’t mining yet — it’s still in exploration mode — but Lamb says the label change already altered the vibe.

“Investors… government agencies, they answer the phone [now],” Lamb said. “It used to be you call and call, nobody answers, and nobody cares. But now they answer.”

To be clear, he’s not pretending federal cash is already flowing.

“Money doesn’t just start falling from the sky, unfortunately,” he said.

The new critical-mineral status lands at a moment when the US has been reminded — loudly — that it doesn’t control much of its own uranium supply.

Russia’s invasion of Ukraine rattled global energy markets and put extra focus on how tangled uranium sourcing can be. About 43% of the world’s uranium comes from Kazakhstan, and a chunk of that supply chain runs through Russia for processing into nuclear fuel, according to Lamb.

“If 43% of the world’s uranium goes offline, then the US is really in a bind,” he said.

That’s why, in his view, the “critical” label isn’t just symbolism. It could mean faster permitting and better odds at funding support for domestic projects trying to scale up.

Wyoming isn’t starting from scratch. A recent federal report shows three of the nation’s five active domestic uranium mines are in Wyoming, and there’s also another proposed project being discussed across roughly 2,000 acres between Fremont and Sweetwater counties.

Geology helps. So does history: the US was the world’s top uranium producer from the early 1950s until about 1980, before economics and safety concerns pushed the industry into a long slump.

But even with demand rising again, Lamb says US uranium still faces a price problem.

Uranium trades around $75 per pound globally, he said. To make US production financially workable, he argues it needs to be closer to $120 per pound — unless government investment closes that gap.

“The US is starting on its back foot,” Lamb said, “but that’s what all this government investment is for.”

Even if Wyoming pulls more uranium out of the ground, it still has to be turned into usable fuel. That’s where another Wyoming bet comes in.

In mid-December, the state announced $100 million to support BWXT’s proposed nuclear fuel manufacturing facility near Gillette. BWXT, a Virginia-based company, wants to produce TRISO fuel — tiny uranium-based kernels wrapped in protective layers designed to handle the higher temperatures expected in next-generation reactors. If it all works out, the plant could be running by 2030.

The BWXT award is the first project backed by Wyoming’s Large Project Energy Matching Fund, managed by the Wyoming Energy Authority — a program that’s drawn political heat in recent legislative sessions because the governor has final approval power.

State leaders are pitching uranium and nuclear as a way to grow jobs, boost revenue and align with President Trump’s “energy dominance” agenda.

But Wyoming also carries scars from the last uranium boom. Mining in the 1950s left parts of the Wind River Reservation dealing with radioactive contamination, and those impacts are still felt today — a reminder that a new uranium push will face scrutiny alongside the sales pitch.

For Myriad Uranium, the road is still long: more drilling, more permits, and eventually proving the resource can be mined economically. But in Lamb’s telling, uranium becoming “critical” has already flipped one switch — attention.

Now the question is whether federal investment flips the next one.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned