Market Jitters Hit Tech Hard — Bitcoin Tumbles ~8% and South Korea’s Kospi Leads the Rout

Markets got shaky Thursday as a fresh tech sell-off rippled through stocks and crypto — bitcoin crashed as much as 8% and South Korea’s Kospi took the lead, sliding nearly 4%.

Bitcoin briefly dropped to about $69,000 before drifting back toward $71,000 early Thursday, hitting its lowest level since November 2024. Traders said part of the hit came after Treasury testimony in Washington that the government can’t order banks to buy crypto — a line that spooked some of the rallies that had pushed digital assets higher.

The pain was most visible in Seoul. The Kospi plunged roughly 3.9%, with heavyweight Samsung Electronics and chip rival SK Hynix falling roughly 5.8–6.7% as investors fled semiconductors and other high-flying tech names. Asian markets from Tokyo to Shanghai also finished weaker, while Hong Kong eked out a tiny gain.

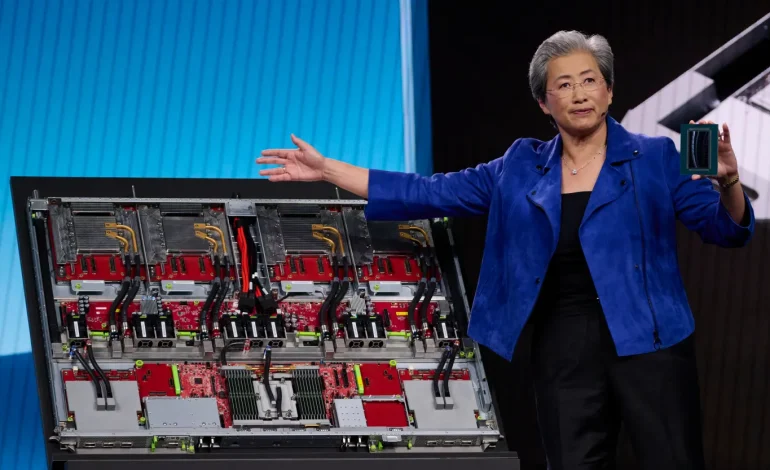

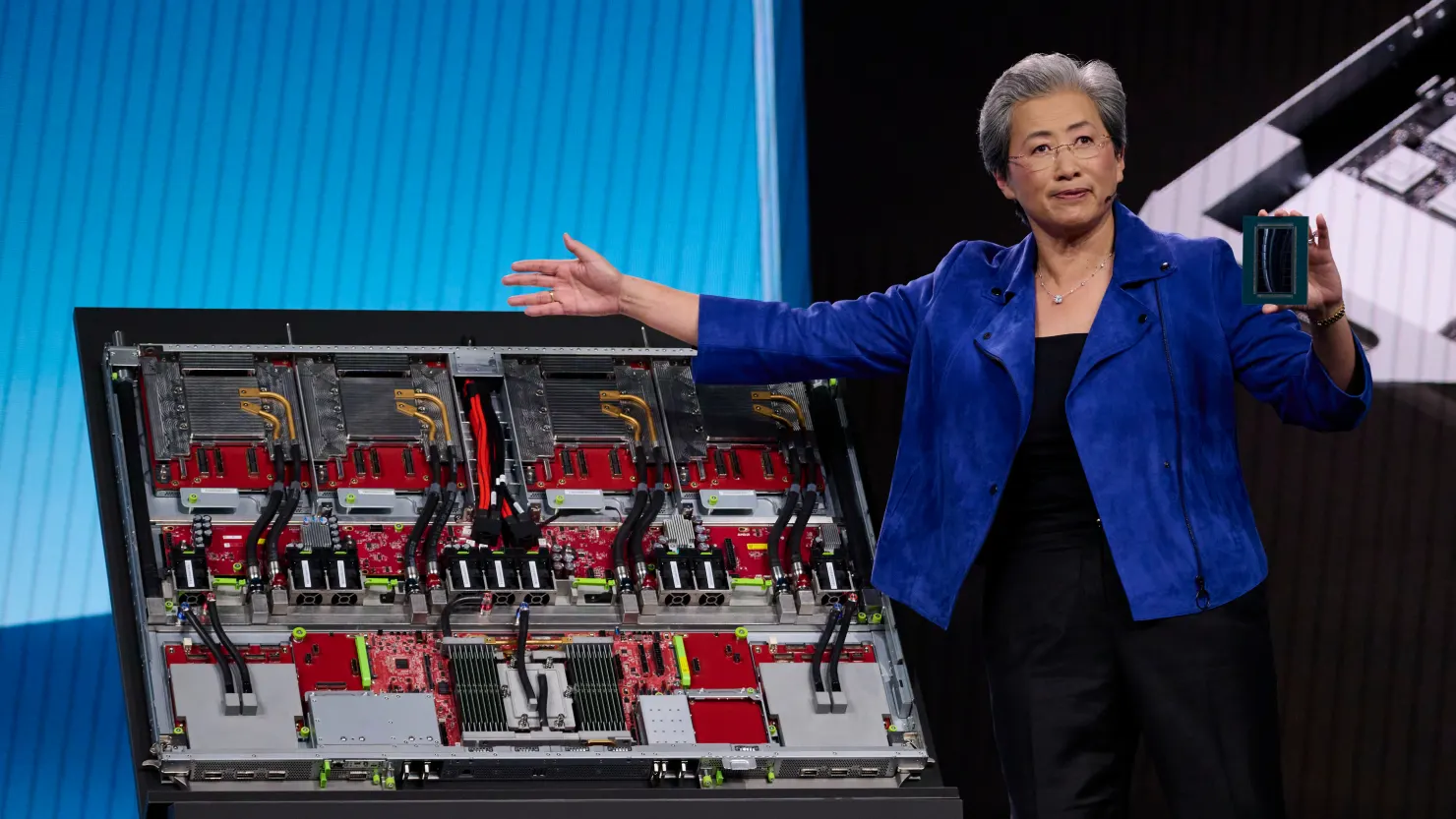

Back in the US, the tech sell-off showed up in some dramatic single-stock moves. Advanced Micro Devices plunged about 17% after investors balked at its outlook despite decent quarterly numbers — a reminder that even good results won’t save richly priced tech stocks if sentiment turns. Other names that disappointed, like Uber, also slid, while AI-hardware winners such as Super Micro popped after beating expectations.

Commodities and FX weren’t spared. US crude fell more than $1 a barrel, trading near the mid-$60s, and Brent dropped by a similar amount — moves traders linked to easing geopolitical risk and broader risk-off pressure. Gold ticked up modestly while silver plunged, underscoring the frenzied repositioning across asset classes. The dollar nudged higher against the yen and the euro slipped slightly.

The rally in tech and crypto is proving fragile. Investors who piled into moonshot valuations are getting reminded that a clean beat isn’t the same as a durable story — and that headlines from Washington can spark big swings in digital assets overnight.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned