OPINION: America’s money is leaking, Bitcoin is getting tested, not replaced

Four weeks into the new year, the American economy is sending a familiar mixed signal: spending still looks “resilient,” but the pressure underneath it is getting harder to ignore. Credit card debt is above $1.23 trillion, inflation has not disappeared for households that feel every grocery run, and the gap between who can keep spending and who can’t is widening. In that environment, two very different consumer habits start to look like they belong in the same story: the quiet, years-long drift into more expensive tech life, and the loud, public stress test playing out in crypto markets.

A new analysis from InvestorsObserver puts a sharp number on something many people sense without measuring: Americans have dramatically increased their spending on telephone and communication equipment since the late 1990s, even after adjusting for inflation. The headline statistic is blunt: in several states, household spending in this category is up more than 600% between 1997 and 2024. North Carolina tops the list, with spending now more than seven times late-1990s levels. North Dakota and Washington are also leading states in the decades-long jump, according to the release.

The study is built on federal Personal Consumption Expenditure data from the US Bureau of Economic Analysis across all 50 states from 1997–2024, with inflation adjustments meant to make it comparable over time. InvestorsObserver says it then cross-referenced those spending trends with credit loan trends (sourced from Bloomberg) from American Express, Discover and Capital One spanning 2018–2025. The argument is not that phones caused the debt problem, it’s that this is a large, persistent budget drain that has been easy to normalize because it arrives in clean boxes, in small monthly payments, marketed as necessity.

“Many people treat phone upgrades like air. The spending surge since 1997 shows they are locked in a tech-upgrade cycle that’s harder to break than most resolutions,” said Sam Bourgi, senior analyst at InvestorsObserver.

That “cycle” matters because it sits right at the intersection of psychology and personal finance: the purchase feels productive, modern, even responsible, but it behaves like a luxury habit when it hits a balance sheet. The release points out that several states have posted eye-catching growth even recently, Washington and South Dakota each jumped 37% from 2020–2024, while Texas rose 21% over the same period, suggesting this is not just a legacy effect from the smartphone revolution, but a spending pattern that keeps renewing itself.

Bourgi’s warning is unusually direct for a consumer-spending dataset.

“Every 2–3 years, people in these states swap for the newest model. These devices lose half their value the moment they leave the store. When you combine that with the fact that credit card balances have grown a lot since 2018, largely financing these same tech purchases, you’re looking at families and individuals paying interest on depreciating assets,” he noted.

What turns this from a lifestyle observation into an economic story is the wider context: not all households are living in the same economy at the same speed. New data from the Federal Reserve Bank of New York has shown higher-income households increasing inflation-adjusted spending more quickly than middle- and lower-income groups since 2023, while lower-income and rural households faced higher inflation late last year than higher-income households.

The pattern is the one economists often summarize as a “K-shaped” economy, the top keeps climbing, the bottom keeps grinding, and the middle keeps trying to maintain the appearance of normal.

Against that backdrop, the phone-upgrade surge reads less like a quirky consumer preference and more like a structural pressure point. A household can be “resilient” for a while: until interest rates, unexpected bills, or a job wobble turns convenience into compounding cost. Bourgi leans into that contradiction.

“People enjoy buying, it boosts our mood, it shows off wealth. On the surface it seems positive, and the economy remains resilient. But if your paycheck hasn’t grown as fast as your spending, that resilience can easily turn into a debt problem by mid-year, which is why the tech spending diet is your best bet for making resolutions stick,” he said.

That same tension is also showing up in markets that are supposed to be forward-looking. Bitcoin has been sliding for months, shedding a large chunk of value from its October peak, even as geopolitical risk has increased and gold has rallied. The backdrop here matters because it cuts against the popular “digital gold” narrative: if Bitcoin is a safe haven, this would normally be its moment. Instead, it has behaved more like a risk asset caught in a tightening financial environment.

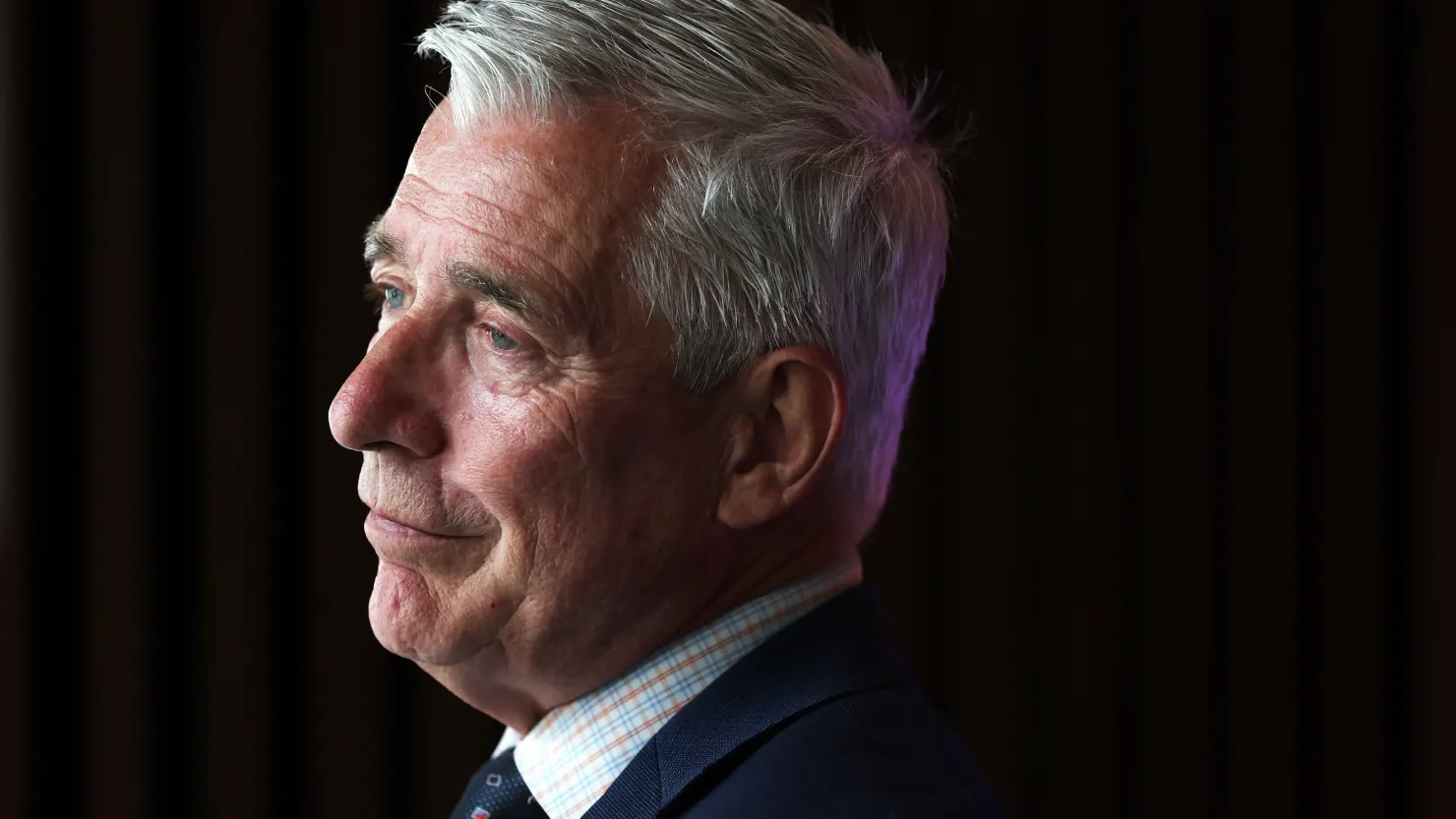

In the past several days, however, Bitcoin has been holding in a higher range again, stabilizing between roughly $75,000 and $80,000 after a sharp sell-off, and that steadiness has become its own signal. Nigel Green, CEO of financial advisory giant deVere Group, frames the moment through the lens that tends to dominate all risky assets when things get jumpy: the dollar.

“The dollar is flexing,” he said. “This always creates friction for Bitcoin in the short term. What matters is that prices are holding firm at elevated levels rather than unwinding.”

His point is less cheerleading than diagnosis: a stronger dollar tightens global liquidity and pulls attention back toward cash-like assets. In that climate, Bitcoin doesn’t need a heroic rally to look healthy, it needs to avoid collapsing under pressure. Green argues that’s what the market has been doing.

“This behavior points to a market that is absorbing pressure, not buckling under it, which is, typically, how bases are built.”

The macro storyline he’s describing overlaps with what broader reporting has highlighted: shifting expectations around US monetary policy leadership, upcoming labor market data, and a more cautious risk mood have all been feeding the dollar’s momentum. And in crypto, momentum is not just a chart pattern, it’s oxygen. When it thins out, the most leveraged, most impatient money leaves first.

Green’s core claim is that dollar strength can interrupt Bitcoin without redefining it.

“Dollar rallies have a history of interrupting Bitcoin’s momentum, not reversing it,” he explained. “They, typically, slow the move, they don’t cancel the destination.”

He also insists this is not the same market structure as earlier boom-and-bust cycles, largely because demand is no longer mostly retail-driven.

“This is a very different market from earlier cycles,” said Nigel Green. “Bitcoin is no longer reliant on retail enthusiasm alone. Structural demand is broader, steadier and more disciplined.”

That argument exists alongside more skeptical voices in the background reporting. Analysts have pointed to declining institutional appetite at points, and to the broader question hanging over crypto after a turbulent decade: what role is Bitcoin actually settling into, speculative trade, portfolio hedge, alternative monetary asset, or something that shifts depending on the month?

The reality can hold two things at once: Bitcoin can be “maturing,” and still be volatile enough to punish anyone who treats it like a savings account.

Where Green goes next is closer to the long-horizon investment case: scarcity and macro uncertainty.

“Persistent currency debasement risks, rising sovereign debt burdens and geopolitical strain continue to strengthen the investment case for scarce digital assets,” he said. “Those forces do not disappear because the dollar has a strong fortnight.”

Taken together, Bourgi’s consumer-spending analysis and Green’s market readout describe the same underlying mood from different angles. Households are still buying, but the spending is increasingly stratified, and often financed. Markets are still trading, but confidence is selective, and often conditional on macro variables people don’t control. In that kind of environment, the “big” economic story isn’t just whether people spend or whether Bitcoin rallies. It’s how quickly stability can turn into stress when costs rise faster than real flexibility.

Green describes Bitcoin’s current behavior in language that could just as easily apply to household balance sheets trying to recover after a bad quarter: consolidation can be constructive, but only if it’s used to reset, not deny reality.

“Periods of consolidation near highs are historically constructive,” said Nigel Green. “They allow leverage to reset, conviction to strengthen and long-term capital to establish positions.”

Bourgi’s “tech spending diet” is aimed at the same reset on the consumer side: break the upgrade reflex, stop paying interest on things that lose value, and give your budget space to breathe before the year’s pressures stack up. Green’s conclusion is that Bitcoin is doing its own version of that, holding up under tightening conditions, not pretending they don’t exist.

“The dollar may be asserting itself today,” he said. “Bitcoin is, arguably, asserting something bigger. Scarcity, adoption and credibility are doing the work beneath the surface.”

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned