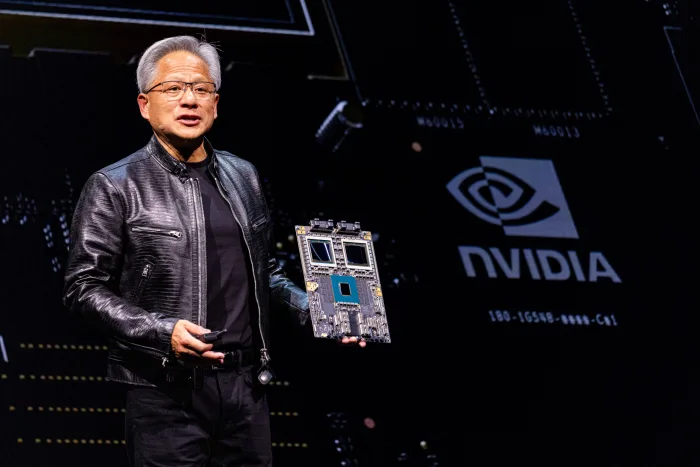

As one of the most influential companies in the stock market, Nvidia (NVDA) is set to release its fourth-quarter earnings this Wednesday, and the results could have a major impact on the S&P 500 and broader market sentiment.

Nvidia has experienced an extraordinary rise over the past year, driven by its dominant role in artificial intelligence (AI) chip manufacturing. The company’s Blackwell GPUs have been in high demand, and Nvidia’s market value has soared, briefly making it the world’s most valuable company multiple times in 2024 and 2025.

Currently, Nvidia holds a market capitalization of approximately $3.3 trillion, making it the second-most valuable company globally, behind Apple (AAPL) and ahead of Microsoft (MSFT).

However, Nvidia’s stock performance in 2025 has been more volatile. After a 171% gain in 2024, shares have remained relatively flat this year. Investors are now looking to the earnings report for signs of continued momentum or potential headwinds.

Nvidia’s earnings report will be closely watched for several key indicators, including:

- Revenue Growth: Analysts estimate quarterly revenue of $38.2 billion, representing a 72.6% increase year-over-year.

- Earnings Per Share (EPS): Expected at $0.85 per share, up 60% from a year ago.

- Full-Year Projections: Analysts predict $129.3 billion in revenue (up 112%) and $2.95 EPS (up 127%).

- Production and Supply: Nvidia needs to scale up production to meet demand and maintain its market dominance.

- Competition: Growing threats from rivals, including Chinese AI company DeepSeek, which claims to build AI systems at lower costs using alternative chips.

Given Nvidia’s significant weight in the S&P 500, its earnings report could have a ripple effect on the broader stock market. Investors are already bracing for potential volatility, as Nvidia’s stock has historically moved by an average of 9.2% after earnings reports, affecting the S&P 500 and Nasdaq Composite Index.

Additionally, concerns over inflation, tariffs, and economic uncertainty have already led to recent market declines, with the S&P 500 falling 1.6% last week. Nvidia’s earnings could either restore confidence in the AI sector or trigger further sell-offs if expectations are not met.

Several other major companies will report earnings alongside Nvidia, further shaping market trends:

- Salesforce (CRM): Expected to report $2.61 EPS, up 14% from last year.

- Dell Technologies (DELL): Expected $2.51 EPS on $24.5 billion in revenue.

- Retail Sector: Home Depot (HD), Lowe’s (LOW), and TJX (TJX) will provide insights into consumer spending trends.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned