Samsung Electronics has warned that escalating US tariffs and global trade tensions pose risks to consumer demand for its electronics products, including smartphones and semiconductor components.

The caution comes as the South Korean tech giant reported record first-quarter revenue, buoyed by robust mobile device sales and early stockpiling ahead of anticipated import duties.

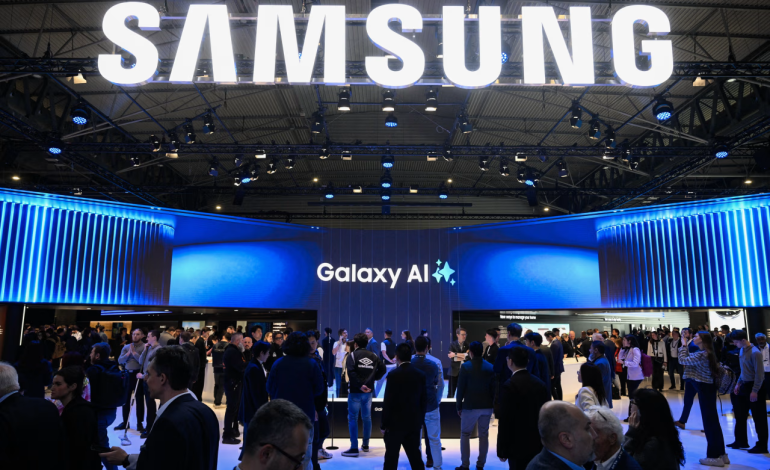

For the three months ending March 31, Samsung posted revenue of 79.1 trillion won ($58 billion), a 10% increase from the same period last year. Net profit rose 22% to 8.2 trillion won, and operating profit climbed 1.2% to 6.7 trillion won. Strong demand for its new AI-enabled Galaxy smartphones helped drive mobile segment earnings to their highest in four years, with a 23% rise in operating profit to 4.3 trillion won.

Despite the positive financial results, Samsung highlighted “ongoing uncertainty” related to US trade policies, particularly tariffs introduced by President Donald Trump. Executives warned these measures could lead to a slowdown in demand in the second half of the year.

The most significant tariffs, which have been delayed until July for most countries except China, could impact Vietnam and South Korea—key manufacturing hubs for Samsung. The company has been accelerating production in these regions to mitigate potential supply chain disruptions.

Meanwhile, US restrictions on the export of artificial intelligence (AI) chips to China are weighing on Samsung’s semiconductor division. Operating profit in that unit fell 42% year-on-year to 1.1 trillion won, amid falling sales of high-bandwidth memory (HBM) chips and increasing competition from local rival SK Hynix.

Samsung acknowledged the impact of reduced demand in the AI chip sector due to export controls and postponed purchases by customers awaiting its next-generation HBM3E chips, expected later this year. The company also refrained from providing an earnings forecast for the current quarter, citing “growing macroeconomic uncertainties” and fluctuating trade dynamics.

Reuters, the Wall Street Journal, and the Independent contributed to this report.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned